Rating Information

| Rating Agency | Long-term Credit Rating |

Short-term Credit Rating |

|---|---|---|

| Japan Credit Rating Agency, Ltd (JCR) |

AA- (Stable) | J-1+ |

(As of end of June 2024)

Overview of Bonds

Straight Bonds

| Name | Date of issue | Total amount of issues | Interest rate | Date of redemption |

|---|---|---|---|---|

| The fifth series of unsecured bonds | April 24, 2014 | ¥10 billion | 0.949% | April 24, 2024 |

| The sixth series of unsecured bonds | October 22, 2018 | ¥20 billion | 0.494% | October 20, 2028 |

| The seventh series of unsecured bonds | June 25, 2019 | ¥20 billion | 0.200% | June 25, 2024 |

| The eighth series of unsecured bonds | June 25, 2019 | ¥20 billion | 0.300% | June 25, 2026 |

| The ninth series of unsecured bonds | June 25, 2019 | ¥15 billion | 0.400% | June 25, 2029 |

| The tenth series of unsecured bonds (Sustainability-Linked Bonds) |

October 15, 2020 | ¥10 billion | 0.440% *1 | October 15, 2030 |

| The eleventh series of unsecured bonds | April 13, 2023 | ¥40 billion | 0.320% | April 13, 2026 |

| The twelfth series of unsecured bonds | February 29, 2024 | ¥13 billion | 0.610% | February 28, 2029 |

(As of end of June 2024)

- *1With a step-up clause

Subordinated Bonds : Rating A

| Name | Date of issue | Total amount of issues | Initial interest rate | Date of redemption |

|---|---|---|---|---|

| The second series of subordinated bonds | July 2, 2020 |

¥120 billion | 1.28% | July 2, 2055 *1 |

| The third series of subordinated bonds | July 2, 2020 |

¥40 billion | 1.40% | July 2, 2057 *2 |

| The fourth series of subordinated bonds | July 2, 2020 |

¥40 billion | 1.56% | July 2, 2060 *3 |

| The fifth series of subordinated bonds | October 19, 2022 |

¥46 billion | 1.435% | October 19, 2057 *4 |

| The sixth series of subordinated bonds | October 19, 2022 |

¥30 billion | 1.849% | October 19, 2062 *5 |

(As of end of June 2024)

- *1Hulic may, at its discretion, redeem the Hybrid Bonds on July 2, 2025 or any interest payment date thereafter

- *2Hulic may, at its discretion, redeem the Hybrid Bonds on July 2, 2027 or any interest payment date thereafter

- *3Hulic may, at its discretion, redeem the Hybrid Bonds on July 2, 2030 or any interest payment date thereafter

- *4Hulic may, at its discretion, redeem the Hybrid Bonds on October 19, 2027 or any interest payment date thereafter

- *5Hulic may, at its discretion, redeem the Hybrid Bonds on October 19, 2032 or any interest payment date thereafter

Sustainability-Linked Bonds

Hulic has issued Japan’s first Sustainability-Linked Bonds (“the Bonds”) in October 15,2020.

For the issuance of the Bonds, the Company applied for “the Public Offering for Model Cases in the Model Creation Projects on Sustainability Linked Loans 2020” launched by the Ministry of the Environment (the “Public Offering”) and the Bonds were highly evaluated for the modeling and pioneering features and selected as the first model case in the Public Offering.

The Bonds are the world’s first publicly offered Sustainability-Linked Bonds that align with the “Sustainability Linked Bond Principles” (“SLB Principles”) published by The International Capital Market Association (“ICMA”) (as of the date of this announcement).

In February 2021, we received the silver prize as well as the Minister of the Environment award in the issuer category of the second ESG Finance Award Japan hosted by the Ministry of the Environment for this bond issuance.

Third-party verification

The compliance of the bonds with the Ministry of Environment Guidelines and SLB Principles has been confirmed by the Ministry of Environment and its contractors (JCR, E&ES).

Progress against the targets is reviewed annually by JCR.

Post-Issuance Verification Report

(Japanese, issued in August 2021)

Post-Issuance Verification Report

(Japanese, issued in August 2022)

Post-Issuance Verification Report

(Japanese, issued in September 2023)

Post-Issuance Verification Report

(Japanese, issued in October 2024)

Post-Issuance Verification Report

(Japanese, issued in October 2025)

Overview of the Bonds

| 10th series unsecured subordinated bonds (with an inter-bond pari passu clause, Sustainability-Linked Bonds) |

|

|---|---|

| Maturity | 10 years |

| Issue amount | 10 billion yen |

| SPTs linked with the issue terms |

|

| Interest rate | An interest rate of 0.44% per annum will be applied during the period from the day immediately following October 15, 2020 through October 15, 2026. A coupon step-up of 0.10% is triggered if any of the SPTs linked with the issue terms has not been achieved as of August 31, 2026 |

| Pricing date | October 9, 2020 |

| Issue date | October 15, 2020 |

| Maturity date | October 15, 2030 |

| Credit rating | A+ (Japan Credit Rating Agency Ltd., “JCR”) |

SPTs&Progress against targets

1. Achieve RE100 goals by the end of FY2025

In 2020, Hulic began RE100 initiatives to convert to 100% electricity sourced from renewable energy for the electricity consumed across the Group, including subsidiaries. The aim was to achieve the RE100 goals by the end of FY2025.

As a result of efforts to promote the development of new solar photovoltaic equipment, we achieved the RE100 goals as of May 2023, two years ahead of schedule.

This is the first time in Japan that a company has achieved the RE100 goals by developing new solar photovoltaic equipment without relying on existing renewable energy plants and equipment.

Progress against the target

List of solar photovoltaic equipment developed by the Company

| Completion | Location |

|---|---|

| October 2020 | Kazo City 1, Saitama Prefecture |

| January 2021 | Omiya Town 1, Wakaba Ward, Chiba Prefecture |

| February 2021 | Meishizawa, Tamura City, Fukushima Prefecture |

| March 2021 | Gotomaki, Tamura City, Fukushima Prefecture |

| April 2021 | Kikutamachi, Koriyama City, Fukushima Prefecture |

| May 2021 | Kazo City 2, Saitama Prefecture |

| May 2021 | Kakeuma,Amimachi, Inashiki District, Ibaraki Prefecture |

| September 2021 | Hiwadamachi, Koriyama City, Fukushima Prefecture |

| October 2021 | Mihotamachi, Koriyama City, Fukushima Prefecture |

| November 2021 | Atamimachi 1, Koriyama City, Fukushima Prefecture |

| November 2021 | Wakakodama, Gyoda City, Saitama Prefecture |

| December 2021 | Omiya Town 2, Wakaba Ward, Chiba Prefecture |

| December 2021 | Koumimachi, Minamisaku District, Nagano Prefecture |

| December 2021 | Matate, Bandou City, Ibaraki Prefecture |

| December 2021 | Kazo City 3, Saitama Prefecture |

| December 2021 | Oppara,Amimachi, Inashiki District, Ibaraki Prefecture |

| April 2022 | Atamimachi 2, Koriyama City, Fukushima Prefecture |

| April 2022 | No, Gyoda City, Saitama Prefecture |

| April 2022 | Mibukou, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| April 2022 | Kaiharatsukamachi, Ryugasaki City, Ibaraki Prefecture |

| May 2022 | Ozatomutsuai Town, Tsu City, Mie Prefecture |

| May 2022 | Taki Town, Taki District, Mie Prefecture |

| May 2022 | Kizawa, Oyama City, Tochigi Prefecture |

| May 2022 | Kazo City 4, Saitama Prefecture |

| May 2022 | Fujimimachi, Suwa District, Nagano Prefecture |

| May 2022 | Higashinoda, Oyama City, Tochigi Prefecture |

| May 2022 | Shimoishibashi, Shimotsuke City, Tochigi Prefecture |

| May 2022 | Koganei, Shimotsuke City, Tochigi Prefecture |

| May 2022 | Kaminokawamachi, Kawachi District, Tochigi Prefecture |

| May 2022 | Fujii 1, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| May 2022 | Fujii 2, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| September 2022 | Narisawa, Kumagaya City, Saitama Prefecture |

| October 2022 | Ojimacho, Ota City, Gunma Prefecture |

| October 2022 | Nakagawara, Inawashiro Town, Fukushima Prefecture |

| November 2022 | Sakai 2, Fujimicho, Nagano Prefecture |

| November 2022 | Nakane, Inzai City, Chiba Prefecture |

| November 2022 | Kamimuzata, Togane City, Chiba Prefecture |

| November 2022 | Ushibukuro, Kisarazu City, Chiba Prefecture |

| December 2022 | Sekishinden, Konosu City, Saitama Prefecture |

| December 2022 | Shirakawado, Gyoda City, Saitama Prefecture |

| January 2023 | Omiya Town 3, Wakaba Ward, Chiba Prefecture |

| January 2023 | Fujimi 1, Fujimi Town, Nagano Prefecture |

| January 2023 | Fujimi 2, Fujimi Town, Nagano Prefecture |

| January 2023 | Umezawa, Honjo City, Saitama Prefecture |

| April 2023 | Kokubunji, Shimotsuke City, Tochigi Prefecture |

| May 2023 | Kinuita, Shimotsuke City, Tochigi Prefecture |

| May 2023 | Geino Town, Tsu City, Mie Prefecture |

| May 2023 | Tokiwa Town, Tamura City, Fukushima Prefecture |

| May 2023 | Kanoko, Ishioka City, Ibaraki Prefecture |

| September 2023 | Sakuradai,Ushiku City, Ibaraki Prefecture |

| September 2023 | Higashinoda 3, Oyama City, Tochigi Prefecture |

| October 2023 | Chiyosato 3, Koumimachi, Minamisaku District, Nagano Prefecture |

| October 2023 | Chiyodamachi 6, Oura District, Gunma Prefecture |

| October 2023 | Shimazu, Amimachi, Inashiki District, Ibaraki Prefecture |

| October 2023 | Yagii, Kumagaya City, Saitama Prefecture |

| November 2023 | Toyosato 2, Koumimachi, Minamisaku District, Nagano Prefecture |

| November 2023 | Toyosato 3, Koumimachi, Minamisaku District, Nagano Prefecture |

| November 2023 | Uchimoriyamachi 3, Joso City, Ibaraki Prefecture |

| December 2023 | Tatsuzawa 2, Fujimi Town, Nagano Prefecture |

| December 2023 | Omiya Town 5, Chiba Prefecture |

| December 2023 | Toyosato 1, Koumimachi, Minamisaku District, Nagano Prefecture |

| December 2023 | Hiroda 1, Konosu City, Saitama Prefecture |

| December 2023 | Hiroda 2, Konosu City, Saitama Prefecture |

| December 2023 | Hiroda 3, Konosu City, Saitama Prefecture |

| December 2023 | Kaiharatsukamachi 3, Ryugasaki City, Ibaraki Prefecture |

| December 2023 | Uchinoyama, Bando City, Ibaraki Prefecture |

| January 2024 | Kaminokawamachi 5, Kawachi District, Tochigi Prefecture |

| March 2024 | Kawada, Nogi Town, Shimotsuga District, Tochigi Prefecture |

| April 2024 | Omiya Town 6, Chiba Prefecture |

| May 2024 | Minamiakatsuka, Nogi Town,Shimotsuga District, Tochigi Prefecture |

| July 2024 | Niijuku 2, Tosho Town, Katori District, Chiba Prefecture |

| August 2024 | Omiya Town 7, Chiba Prefecture |

| October 2024 | Atamimachi 2, Koriyama City, Fukushima Prefecture |

| October 2024 | Tsukinowa, Namegawa Town, Hiki District,Saitama Prefecture |

| November 2024 | Yahagi, Bandou City, Ibaraki Prefecture |

| November 2024 | Kariyado, Bandou City, Ibaraki Prefecture |

| December 2024 | Omiya Town 8, Chiba Prefecture |

| December 2024 | Tomonuma, Nogi Town, Shimotsuga District, Tochigi Prefecture |

| December 2024 | Shimokoike Town, Utsunomiya City, Tochigi Prefecture |

| December 2024 | Tsukubamirai City, Ibaraki Prefecture |

| December 2024 | Fujii 3, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| January 2025 | Kuzuma, Kisarazu City, Chiba Prefecture |

| January 2025 | Sakado Town, Mito City, Ibaraki Prefecture |

| January 2025 | Futto, Inashiki City, Ibaraki Prefecture |

| February 2025 | Hanawa1, Mashiko Town, Haga District, Tochigi Prefecture |

| March 2025 | Minowa, Kumagaya City, Saitama Prefecture |

| March 2025 | Hanawa2, Mashiko Town, Haga District, Tochigi Prefecture |

| March 2025 | Fujii 4, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| April 2025 | Nanai, Mashiko Town, Haga District, Tochigi Prefecture |

| April 2025 | Kozawatari Town, Chuo Ward, Hamamatsu City, Shizuoka Prefecture |

| May 2025 | Tochikubo, Kanuma City, Tochigi Prefecture |

| May 2025 | Hanawa3, Mashiko Town, Haga District, Tochigi Prefecture |

| May 2025 | Kazo City 8, Saitama Prefecture |

| May 2025 | Fujii 5, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| May 2025 | Akabane, Ichikai Town, Haga District, Tochigi Prefecture |

| May 2025 | Sukegai, Mibumachi, Shimotsuga District, Tochigi Prefecture |

| June 2025 | Nissato Town, Utsunomiya City, Tochigi Prefecture |

| June 2025 | Minamiakatsuka2, Nogi Town, Shimotsuga District, Tochigi Prefecture |

| August 2025 | Shimokoike Town3, Utsunomiya City, Tochigi Prefecture |

- Total power generation capacity of solar photovoltaic equipment completed in FY2024: 95.1MW

Solar power generation results and RE100 rate of progress

| Solar power generation results (as of the end of December 2024) |

RE100 rate of progress (as of the end of December 2024)* |

|---|---|

| 100GWh | 173% |

- *RE100 rate of progress is reported to CDP, and the calculation method is as follows.

the amount of power generated by Hulic-owned solar photovoltaic equipment for one year ÷ the total amount of electricity used at the Hulic head office building and on the floors occupied by Group companies in one year

2. Completion of Japan's first 12-story fire-resistant wooden commercial facility in the Ginza 8-chome Development Plan

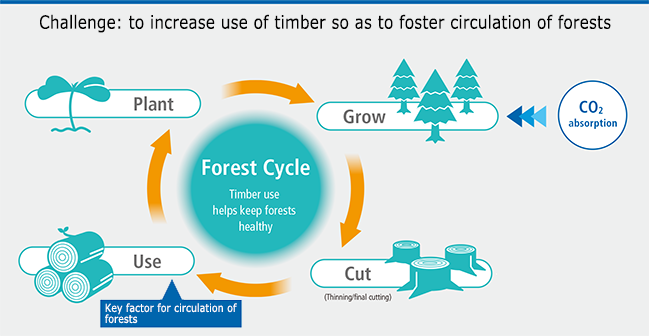

Since 2018, Hulic has been developing fire-resistant wooden buildings using timber that requires less energy for manufacturing and processing, in response to Japan Forestry Agency’s effort to expand use of wood under a series of initiatives to reduce overall CO2 emissions. Trees absorb CO2 in the air and provide a carbon dioxide fixing solution as they grow, so an abundance of trees in the nation’s land can help cut down CO2 levels. Considering trees are losing ability to absorb CO2 as they get older, it is possible to maintain a certain number of young, CO2 absorbing trees by planting new trees after cutting down old trees to use as building materials. This initiative for fire-resistant wooden buildings helps promote forest circulation, which in turn leads to reduction in CO2.

Hulic is developing Japan’s first 12-story, fire-resistant wooden commercial facility (hybrid construction combining mainly domestic wooden and steel structures) in Ginza, one of its focus areas. Construction was completed in October 2021.

Progress against the target

Completed in October 2021.

Forest Circulation

Ginza 8-chome Development Plan (HULIC &New GINZA 8) (fire-resistant commercial building)

| Asset type | Commercial facility |

|---|---|

| Location | Ginza 8-chome (four-minute walk from Shinbashi Station) |

| Structure | Hybrid construction combining wooden and steel structure |

| No. of floors | 12 floors above ground, 1 below |

| Site area | 251.98m2 |

| Total floor area | 2,459.55m2 |

| Design and construction | Takenaka Corporation |

| Exterior design supervisor | Kengo Kuma and Associates |

| Completion | October 2021 |

List of investors that have committed to investing in the Bonds

The list of investors that have committed to investing in the Bonds is included in the press release.

Received the silver prize in the second ESG Finance Award Japan

In February 2021, we received the silver prize as well as the Minister of the Environment award in the issuer category of the second ESG Finance Award Japan hosted by the Ministry of the Environment for this bond issuance.