Hulic aims to maintain sustainable growth, while mitigating and adapting to climate change, through business activities, and we recognize that our climate change response is an important management issue. The effects of climate change are expected to become more apparent over time, so we analyzed the impact of risks and opportunities on our strategy using multiple climate change scenarios and examined resilience of our current strategies including the need to change management plans and basic strategies.

At Hulic, we have been taking actions on strengthening earthquake resistance and disaster prevention measures of our properties, as well as implementing environmental initiatives including decarbonization. As a result, we have found no potential financial impacts that were deemed large related to both transition and physical risks in the scenarios we examined, and have found that our business is sustainable and our strategy is suitably resilient.

Based on our motto of “driving innovation” and “accelerating progress”, we are going ahead with a business model that is able to flexibly respond to changes in external environment. Going forward, we will work for further improvement of our resilience to the social transformation toward decarbonization. We concluded that we will be able to continue improving our corporate value by building a competitive advantage in the leasing and development businesses as valuations increase for environmentally friendly technologies adopted in our properties and seizing opportunities in providing environment-conscious new products and services.

Time Horizon for the Short, Medium, and Long-term

While the real estate industry makes business plans looking 10 years into the future, the effects of climate change will likely become apparent over a far longer period. We have established short-, medium- and long-term time horizons when analyzing the climate change effects in conformity with timeline of our long-term vision for the environment, as well as the target years set by the Paris Agreement and Japanese government.

Hulic's Climate Change Time Horizon:

Confirming with Hulic Long-term Vision for the Environment and Greenhouse Gas Emissions Reduction Targets

Climate Change

| Short-term | Medium-term | Long-term |

|---|---|---|

| 2025 | 2030 | 2050 |

Long-term Vision for the Environment

| 2050年 |

|---|

GHG Emissions Reduction Targets*1

| 2030 | 2050 | |

|---|---|---|

| Scope1 and 2*2 | Reduce by 70% | Substantially zero emissions |

| Scope3*3 | Reduce by 30% | Substantially zero emissions |

- *1Absolute contraction targets, Base Year: 2019. Hulic has had its near-term (by 2030) emissions reduction targets approved by the Science Based Target initiative (SBTi) as consistent with levels required to meet the goals of the Paris Agreement.

- *2Greenhouse gas emissions from directly owned or controlled sources plus indirect purchased energy for business activities.

Scope1: direct emissions (e.g., emissions from natural gas and other fuel combustion).

Scope2: indirect emissions (e.g., emissions from the use of purchased electricity, heat and steam). - *3Greenhouse gas emissions from external companies affiliated with internal business activities (in the supply chain). Targets were set for Categories 11 and 13 of Scope3.

Hulic's management and business time horizons

| Medium- and Long-Term Management Plan (2020-2029) |

||

|---|---|---|

| Phase I | Phase II | Phase III |

| 3 years | 3 years | 4 years |

| By 2022 | By 2025 | By 2029 |

Financial Impact of Climate Change

In assessing the financial impact of climate change, we used consolidated ordinary profit among other earning indicators including net sales, operating profit, ordinary profit, and profit attributable to owners of parent as it is especially important key earning indicator for us. We have set the following criteria based on the results of consolidated ordinary profit: JPY 137.4 billion in FY2023 and a forecasted JPY 144.0 billion in FY2024. For classifying impact, we referenced criteria for revising earnings forecasts, a 30% increase or decrease in the consolidated ordinary profit forecast among the “important matters” of the timely disclosure standards of financial instruments exchanges and set such impact as “large”.

Financial impact matrix

| Impact Classification | Ratio to Consolidated Ordinary Profit | Amount / Year |

|---|---|---|

| Large | 30% or higher | JPY 40 billion or more |

| Medium | 15% or higher, less than 30% | JPY 20 billion or more, less than JPY 40 billion |

| Small | 5% or higher, less than 15% | JPY 7 billion or more, less than JPY 20 billion |

| Minimal | Less than 5% | Less than JPY 7 billion |

Businesses Largely Impacted by Climate Change

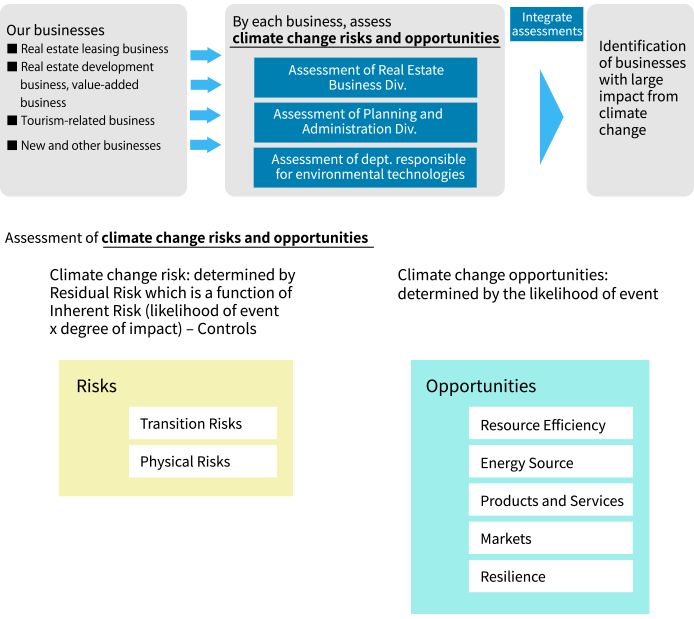

For each Hulic business, we assessed the impact of climate change according to the type of climate change risks and opportunities as outlined by TCFD. Regarding risks, departments within the Real Estate Business Division, the Planning and Administration Division, and the department responsible for environmental technologies first evaluate the inherent risks for each risk type based on the likelihood of event and the degree of impact. The residual risk was then determined by considering the control effectiveness. Opportunities were also evaluated based on the likelihood of event. By integrating the results of these assessments, we selected businesses that could have a large impact from climate change. As a result, real estate business was deemed to have large impacts from climate change, we selected these businesses for a scenario analysis. We may consider to add other businesses to the climate change scenario analysis when these become significantly impacted by climate change and important.

| Businesses subjected to climate change scenario analysis | Businesses excluded from scenario analysis |

|---|---|

|

|

Process for Identifying Businesses with Large Impact from Climate Change

Evaluation of Climate Change-related Risks and Opportunities

1. Identifying Key Drivers of Material Risks and Opportunities

As a pre-process for selecting a group of climate change scenarios, for each type of climate change risk and opportunity according to TCFD, we identified the key drivers of risks and opportunities that could be important to our business and our major stakeholders (factors that could have a significant impact on our business). At the same time, we excluded risks and opportunities that were deemed less impactful and relevant. Identified key drivers of risks and opportunities were as below:

Key Drivers of Identified Risk

Key driver: Factors that are likely to have a large impact on Hulic business and as such parameters were collected when creating scenarios

| Type according to TCFD | Drivers | Identified Key Drivers | |

|---|---|---|---|

| Risk Category | Risk Type | ||

| Transition Risks | Policy and Legal |

|

|

| Technology |

|

|

|

| Society (Market, Reputation) |

|

|

|

| Physical Risks | Acute |

|

|

| Chronic |

|

|

|

Key Drivers of Identified Opportunities

| Type according to TCFD | Drivers | Identified Key Drivers |

|---|---|---|

| Opportunity Type | ||

| Resource Efficiency |

|

|

| Energy Source |

|

|

| Products and Services |

|

|

| Markets |

|

|

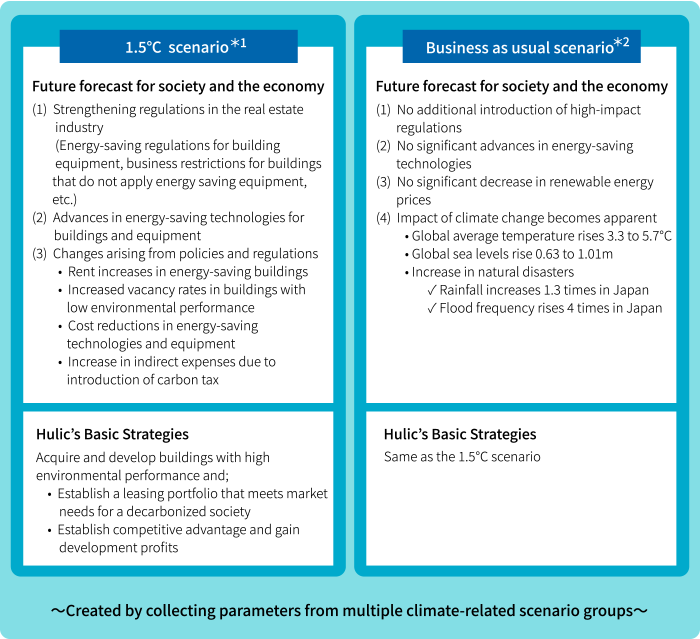

2. Formulation of Climate Change Scenarios

TCFD recommendations propose explaining the resilience of our company strategies in light of an analysis based on different climate-related scenarios including a 2°C or lower scenario. We formulated a 1.5°C scenario and a business as usual scenario by referring multiple climate change scenarios that include key drivers for the material risks and opportunities that were identified.

Overview of Two Scenarios

- *1For scenarios where the global average temperature rise is limited to around 1.5°C by the end of 21 century compared with pre-industrial revolution. TCFD recommended it is imperative that one of the climate change scenarios be a 2°C or lower scenario

- *2Compared with pre-industrial revolution, temperature rises from 3.3 to 5.7°C by the end of 21 century in scenarios without additional measures/responses for climate change mitigation and adaptation

The following is a group of climate change scenarios for which parameters for the identified key drivers were collected when formulating climate change scenarios. We also used estimated values when the parameters for the exact length of time were not found in a scenario group.

Referenced Major Climate Change Scenarios

[Transition risks] policy and legal, technology, market, society, and reputation

| Organization Name | Document Name | Business As Usual Scenario | 1.5°C Scenario |

|---|---|---|---|

| IEA | World Energy Outlook 2023 | STEPS (Stated Policies Scenario) | NZE (Net Zero Emissions by 2050 Scenario) |

| IEA | Net Zero Roadmap A Global Pathway to Keep the 1.5°C Goal in Reach (2023) | STEPS (Stated Policies Scenario) | NZE (Net Zero Emissions by 2050 Scenario) |

[Physical risks] temperature rise, sea level rise, natural disasters (typhoons, floods,wind damage)

| Organization Name | Document Name | Business As Usual Scenario | 1.5°C Scenario |

|---|---|---|---|

| IPCC | Sixth Assessment Report (2021) | SSP5-8.5 | SSP1-1.9 |

| National Institute for Environmental Studies | Climate Change Adaptation Information Platform (A-PLAT) | SSP5-8.5 | SSP1-1.9 |

| WRI | Aqueduct Floods | "Pessimistic" scenario RCP 8.5, SSP 3 | "Optimistic" scenario RCP 4.5, SSP 2 |

| Ministry of Land, Infrastructure, Transport and Tourism, Technical Study Group on Hydraulic Control Plans Based on Climate Change | Recommendations from hydraulic control plan based on climate change (2019) | RCP 8.5 | RCP 2.6 |

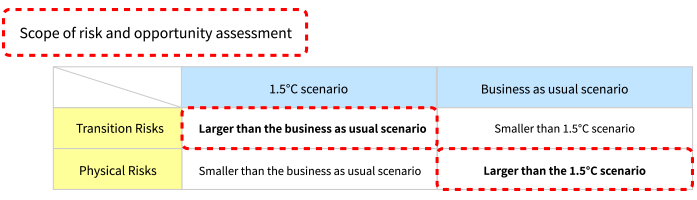

3. Risk and Opportunity Assessment

To examine the impact of climate change risks and opportunities on Hulic’s strategy, we evaluated transition risks and opportunities in the 1.5°C scenario and physical risks and opportunities in the business as usual scenario.

Analysis Result of Financial Impact

| [Medium -term] 2030 |

[Long -term] 2050 |

||||

|---|---|---|---|---|---|

| [Risks] | — | ——— | |||

| Increasing construction costs for compliance with ZEB regulations | — | ——— | |||

| Carbon pricing | — | None | |||

| Expanding disclosure of the performance for energy efficiency of buildings | — | — | |||

| Investing in storage batteries | — | — | |||

| Decarbonizing construction materials | — | — | |||

| Responding to embodied carbon | — | — | |||

| [Opportunities] | + | +++ | |||

| Increase of leasing income due to growing demand for ZEB | + | +++ | |||

| Receipt of ZEB subsidies | + | + | |||

| Financial impacts in the 1.5°C scenario (*1) | Total | — | + | ||

| Flooding (*2) | Impact on real estate value | —— | —— | ||

| Impact on profit | — | — | |||

| Storm surge (*2) | Impact on real estate value | None | — | ||

| Impact on profit | None | — | |||

| Typhoons (wind damage only) | — | — | |||

| Rising temperatures | — | — | |||

| Financial impacts in the business as usual (BAU) scenario (*3) | Total | —— | —— | ||

[Legend] Minimal: —/+, Small: ——/++, Medium: ———/+++, Large: ————/++++

- *1The financial impacts from changes in policies, laws, technologies, and markets due to the transition to a low-carbon society aimed at mitigating climate change.

- *2The impact on all portfolio was estimated based on the results of an analysis of the building portfolio (50 properties), which account for approximately 80% of operating revenue (leasing).

- *3The financial impacts caused by physical risks, such as the occurrence of natural disasters associated with climate change.

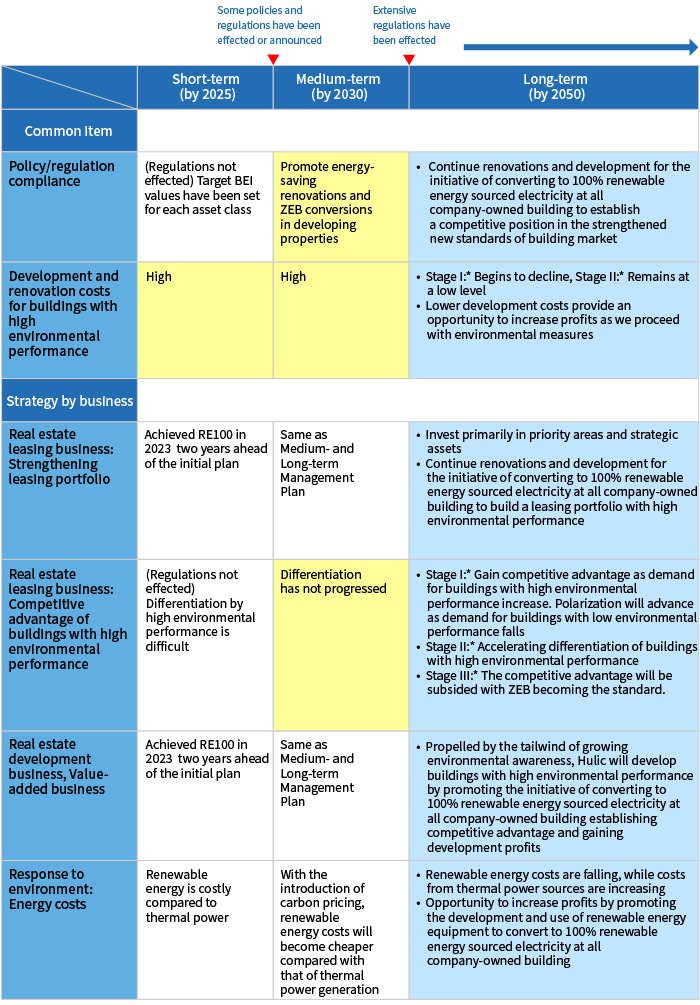

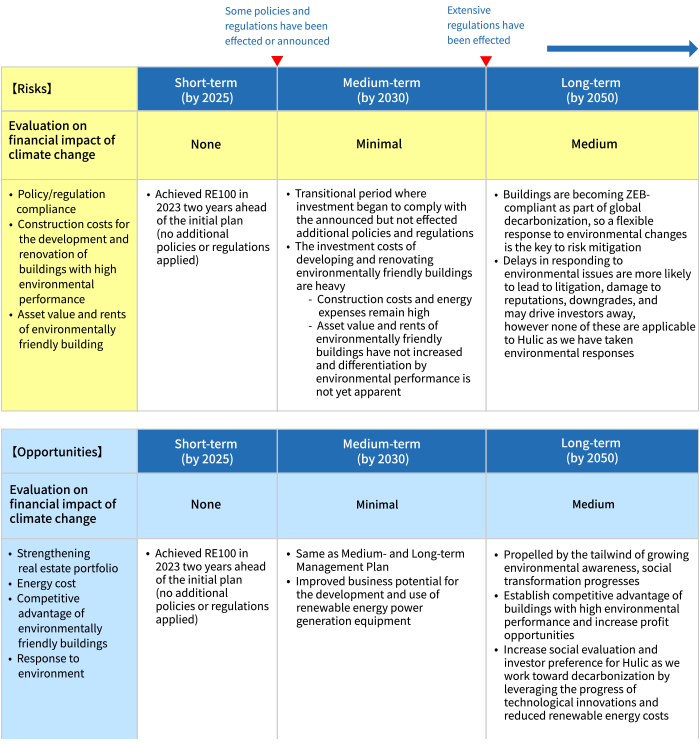

1.5°C Scenario Transition Risks and Opportunities

The financial impact of climate change risk and opportunity were assessed greatest in the “long-term” on the time horizon with the degree of impact at that time was assessed “medium.” Total of financial impact of risk and opportunity was assessed “minimal (positive)”. Under the 1.5°C scenario, we concluded that we will be able to continue improving our corporate value through risk mitigation by flexibly evolving our business model based on current Medium-and Long-term Management Plan against social transformation towards decarbonization by leveraging our motto of “driving innovation” and “accelerating progress”. In addition, as valuations increase for environmental initiatives on our properties, we will build a competitive advantage in the leasing and development businesses. Furthermore, we will seize opportunities in providing environment-conscious new products and services.

1.5°C Scenario Transition Risks and Opportunities

■ Continue on the basic strategies of current Medium-and Long-term Management Plan (further develop and evolve our business model based on the real estate leasing business)

-

[Risk]:

- Increase in costs of responding to a wide range of policies and regulations introduced to address climate change

-

[Opportunity]:

- Increase in valuation of the environmental performance on our properties due to social changes leading to higher sales

- Opportunities to entering new markets that help mitigate climate change will be created

■ Hulic’s Basic Strategies

- *Stages I, II, and III: displays progress in stages.

■ Conclusion:

- Following the basic strategies of the current Medium- and Long-Term Management Plan, we are flexibly responding by deepening our business model and addressing risks. We confirmed that there are no climate change risks that would have a “large” impact on us since we are implementing initiatives for the earthquake resistance, disaster prevention, environmental response, and decarbonization of our properties.

- As valuations increase for environmental initiatives for our properties, we will build a competitive advantage in the leasing and development businesses. Also, we will capitalize on opportunities to provide new environment-conscious products and services as well as improve our corporate value.

- The total financial impact of climate change risks and opportunities has been assessed as “minimal” over the medium-term and “minimal (positive)” over the long-term.

| [Risks and Opportunities] | Short-term (~2025) |

Medium-term (~2030) |

Long-term (~2050) |

|---|---|---|---|

| Evaluation result of financial impact of climate change | None | Minimal | Minimal (positive) |

Financial impact matrix

| Impact Classification | Ratio to Consolidated Ordinary Profit | Amount / Year |

|---|---|---|

| Large | 30% or higher | JPY 40 billion or more |

| Medium | 15% or higher, less than 30% | JPY 20 billion or more, less than JPY 40 billion |

| Small | 5% or higher, less than 15% | JPY 7 billion or more, less than JPY 20 billion |

| Minimal | Less than 5% | Less than JPY 7 billion |

Business as Usual Scenario Physical Risks and Opportunities

Physical risks become apparent as greenhouse gas emissions continue to climb and climate change remains unmitigated. However, the financial impact of climate change has been estimated as “small” on the back of a detailed examination of natural disaster risks conducted when properties are developed or acquired, as well as the mitigation of physical risks through design standards and disaster prevention measures in Hulic properties. Looking at our opportunities, we believe that there will be no financial impact as we do not expect any additional opportunities from climate change.

Business As Usual Scenario Physical Risks and Opportunities

■ Maintain current priority area, location policy and portfolio composition by use as described in the current Medium-and Long-term Management Plan

-

[Risks]:

- Physical risks, such as natural disasters due to climate change, will become apparent and response costs increase

-

[Opportunities]:

- Opportunities up to 2030 have already been incorporated into the Medium-and Long-term Management Plan

- No additional opportunities pertaining to climate change after 2030 and therefore no financial impact

■ Conclusion:

- Sea level rise: The assumption that average global sea levels will rise 0.63 to 1.01m (2100 forecast : base year 1995~2014) is out of scope of the analysis this time.

- Physical risks become apparent as climate change remains unmitigated. The financial impact of climate change has been estimated as “small” over both the medium- and long-term because of a detailed examination of natural disaster risks done when properties are developed or acquired. Another reason for the “small” financial impact is the mitigation of physical risks through design standards and disaster prevention measures in Hulic properties. To further reduce the financial impact of climate change, we will promote a flexible response based on the basic strategies of the Medium- and Long-Term Management Plan.

- The financial impact of climate change opportunities has been estimated to be “none” because the creation of additional opportunities related to climate change is not expected.

| Types of Risk | Risk Event | Risk Scenario | Occurrence | Evaluation on Financial Impact of Climate Change | Basis for Financial Impact Assessment |

|---|---|---|---|---|---|

| Acute Risk | Floods | Frequency of flooding quadruples (2100) | Flood damage | Impact on Real estate value : Small Impact on profit: Minimal |

Implementing countermeasures for flood damage |

| Storm surge | High tides with a recurrence period of 100 years occurs every year(2050–2070) | Flood damage | Impact on real estate value: Minimal Impact on profit: Minimal |

Implementing countermeasures for flood damage | |

| Typhoons | Number of typhoons approaching Japan decreases or pattern changes | Wind damage | Impact on real estate value: Minimal Impact on profit: Minimal |

Damage caused by past typhoons: Minimal | |

| There is a strong possibility that the frequency of severe typhoons (category 4 or higher, maximum wind speed 59 m/s or higher) will increase over the southern seas of Japan | |||||

| Chronic Risk | Sea level rise | Average global sea levels rise 0.63 to 1.01m (projection for 2100 based on 1995-2014) | Flooded/submerged | Out of scope of analysis | Not applicable to the time horizon(up to 2050) |

| Temperature rise | Average temperatures in Tokyo rise 2.0-2.2℃ (projections for 2031-2050 based on 1981-2000) | -Increased cost of air-conditioning equipment expansion -Increased energy costs |

Minimal |

|