Fundamental Approach

Hulic Group recognizes that it is an important business issue to build a corporate governance system with fully functioning internal control, risk management, compliance, and disclosure control.

We intend to sincerely execute business, fulfilling accountability to stakeholders.

Results in FY2024

- Participation rate in the Board of Directors' Meeting: 100 %

- Number of effectiveness assessment of the Board of Directors: 1 time

- Number of compliance training sessions: 7 times (5 times for employees and twice for officers)

- Number of Risk Management Committee meetings: 4 times

- Number of Fund and ALM Committee meetings: 16 times (12 regular meetings and 4 special meetings)

- Number of BCP drills : 3 times

- Number of inspections of stockpiled food: 4 times

- Number of inspections of stockpiled goods: 4 times

Overview of Corporate Governance System and Reason for Adopting Current System

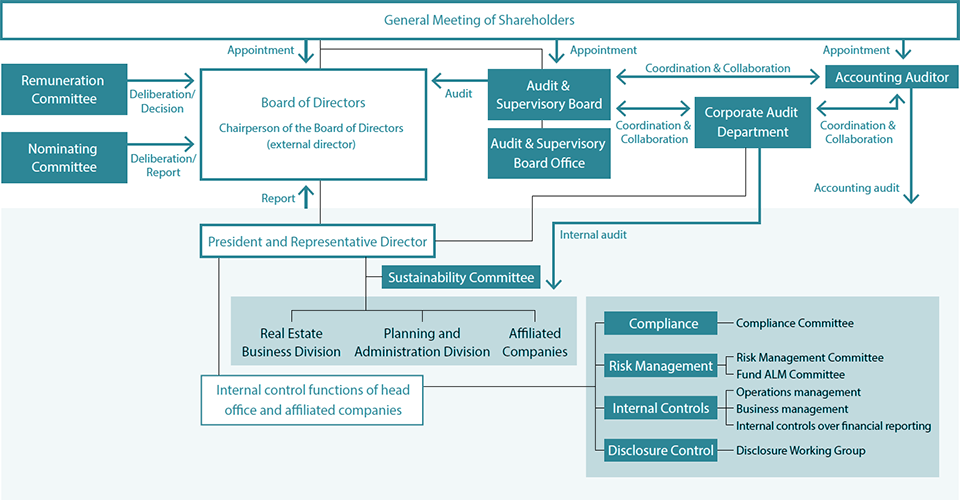

The corporate governance structure of the Company includes bodies such as the Board of Directors, Audit & Supervisory Board, Nominating Committee, Remuneration Committee, Accounting Auditor, and the internal control system. The Company believes that adopting the managing officer system, appointing external officers, and establishing various committees have enabled us to build a corporate governance system that is sound and highly efficient, as well as one that has an optimal structure for us.

Diagram of Hulic’s Corporate Governance (as of April 1, 2025)

The Company Organization

Board of Directors

The Board of Directors resolves issues specified in laws and the Articles of Incorporation as well as important matters related to business execution based on the Board of Directors Rules. The Board also oversees the overall execution of duties of managing officers appointed by the Board. The Board of Directors comprises 10 directors (six are external directors). More than half are external directors and all of these are independent external officers. In addition, an external director serve as the chairperson of the Board of Directors (as of April 1, 2025). The Board holds regular meetings (once a month, in principle), and special meetings of the Board of Directors are held when necessary. The Company is strengthening the oversight role of the Board on overall business execution by directors and managing officers to ensure sound management, such as by adopting the managing officer system. The managing officers are responsible for business execution. In addition, the Company believes effective corporate governance is ensured by reinforcing the structure of the internal audit function and by improving the internal control system. The Company’s Articles of Incorporation stipulate that the Board should consist of no more than 12 members in order to facilitate its functioning.

Audit & Supervisory Board

Hulic is a company with an Audit & Supervisory Board, which includes five Audit & Supervisory Board members (two are full-time auditors and three are External Auditors, following the Companies Act and Ordinance for Enforcement of the Companies Act).

In audit conducted by the Audit & Supervisory Board members, auditors monitor the operations of the internal control system and the status of its implementation through audit of the execution of duties by directors, managing officers, etc. in accordance with the audit basic policy and the audit basic plan formulated by the Audit & Supervisory Board. These audits include attending the Board of Directors meetings as well as other meetings and committees when required, interviews on the execution of duties by directors and managing officers, and reviewing important documents, approval documents and accounting records, etc. The Audit & Supervisory Board Office has been established to support the duties of the Auditor & Supervisory Board members.

Nominating Committee

The Nominating Committee, consists solely of independent external directors, deliberated and submit a report on the appointment of candidates for director and the Audit & Supervisory Board membership.

Remuneration Committee

Specific amounts for the remuneration of directors are deliberated on and determined by the Remuneration Committee, which consists solely of independent external directors, within the limits of the amounts approved at the General Meeting of Shareholders.

Accounting Auditor

The Company has an audit contract with Ernst & Young ShinNihon LLC to conduct audits.

Managing Officer System

We separate oversight of management by the Board of Directors and business execution by introducing the managing officer system to ensure soundness and efficiency of business management.

Committees

We established four committees to ensure cross-departmental deliberation and coordination on company-wide matters.

| Committee Name | Purpose, Matters Deliberated and Coordinated |

|---|---|

| Compliance Committee |

|

| Risk Management Committee |

|

| Fund ALM Committee |

|

| Sustainability Committee |

|

Nominating Committee and Remuneration Committee

We have established “discretionary committees” following the enactment of the Corporate Governance Code, effected on June 1, 2015. All members of each committee are independent external directors from 2019.

Nominating Committee

The Committee deliberates and reports on the nomination of candidates for Directors and Audit & Supervisory Board Members.

Status of activities in FY2024 and specific details to be considered

- Number of events: 1 time

- Details of consideration: Consideration of promotion of directors with titles, examination of the appropriateness of executive directors, consideration of succession plan

Remuneration Committee

When determining the specific remuneration of directors, deliberations and decisions will be made within the range of the amount resolved at the General Meeting of Shareholders.

Status of activities in FY2024 and specific details to be considered

- Number of events: 2 times

- Details of the study: Examination and determination of basic remuneration for each director, examination and determination of performance-linked remuneration for each executive director, consideration and partial revision of the compensation system for executive directors.

Assessment of the Effectiveness of the Board of Directors

The Board of Directors implements an annual self-assessment to continuously ensure its effectiveness, implementing pertinent revisions to Board management based on these evaluations.

Assessment Details

As a result of the analysis and evaluation of the effectiveness of the Board of Directors in FY2024, we judged that governance is functioning effectively because an external director serve as the chairman of the board, the majority of the total members are external directors with diverse expertise, in addition, the percentage of women has exceeded 30%, a culture has been fostered in which each officer can easily express his or her opinions, and appropriate risk-taking and risk management are being carried out.

However, we confirmed that we will recognize and address the following points as ongoing issues for the Board of Directors.

- We will continue to deepen deliberations and discussions on important agenda such as medium- to long-term management policies.

- Present a wide range of risks related to our business and further deepen appropriate risk judgment through the classification and organization of risks.

Feedback from external directors, “Boards management including sharing the explanation materials in advance is efficient and well balanced,” and “From the perspective of diversity, advanced initiatives are promoted and further strengthening of governance is pursued.” “Various opinions are accepted and opinions are exchanged from various perspectives.”